j-51 tax abatement rent stabilization

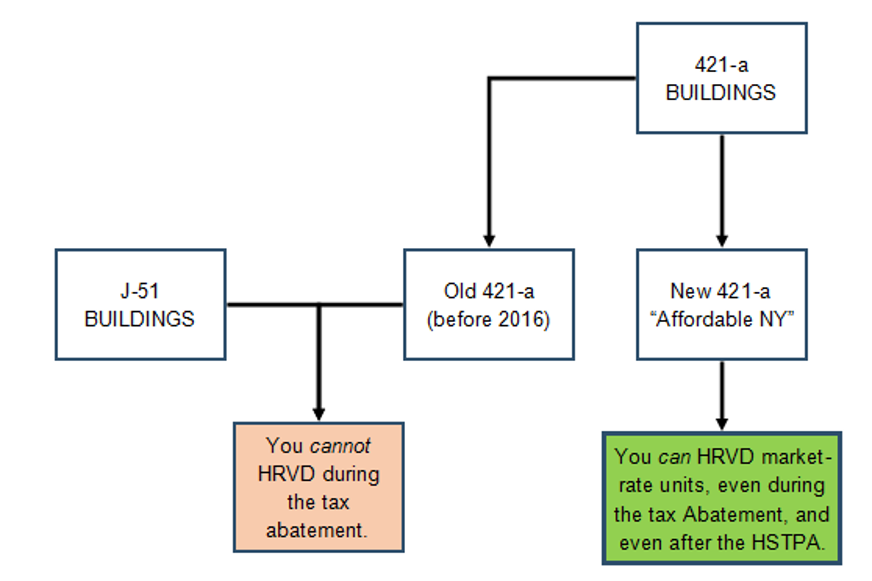

A building owner cannot use the luxury decontrol provisions if the building is receiving J-51 benefits and the only reason the building is in rent stabilization is to receive J-51 benefits. Strong Notice Requirements.

J 51 Tax Breaks And Rent Stabilization Explained Itkowitz

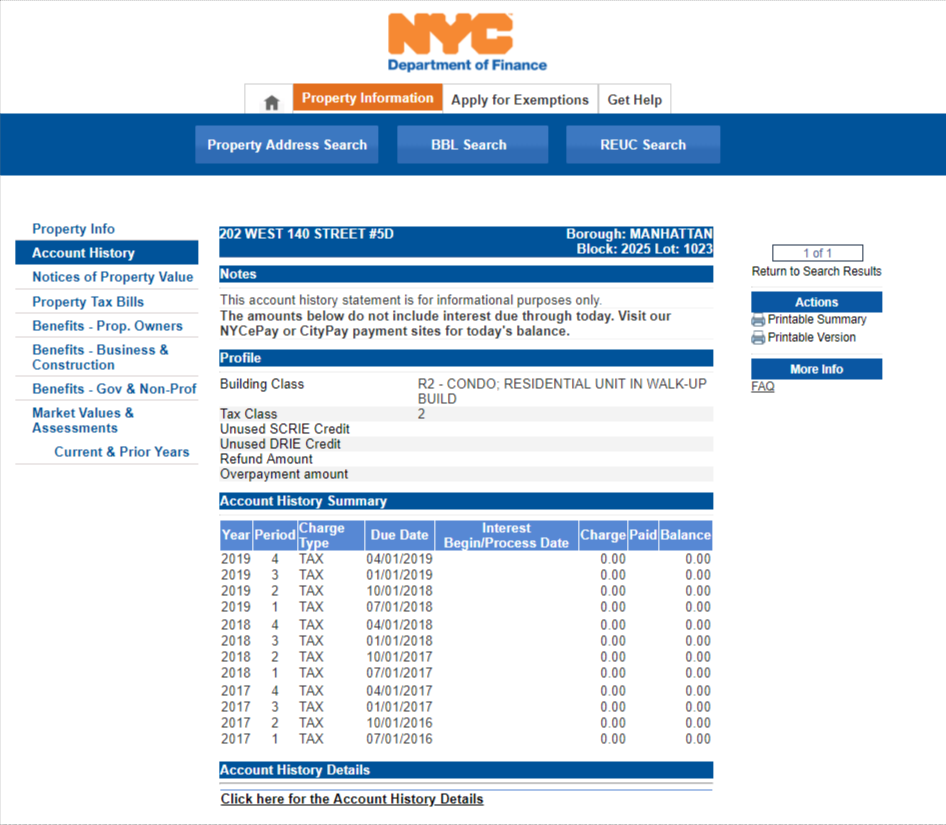

Tax Abatement Application Procedures 1.

. One the most important cases in New. A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started construction. According to the New York City Rent Guidelines Board landlords may or may not be able to raise the rent in buildings with J-51 benefits.

Eligible projects for this program include. It also decreases your property tax. The benefit varies depending on the buildings location and the type of.

The rent is restored at the end of the tax abatement period pursuant to a DHCR issued rent restoration order for rent controlled apartments and an owner filed notice for rent. The J-51 Tax Incentive program is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multi-family housing. The benefit varies depending on the buildings location and the type of improvements.

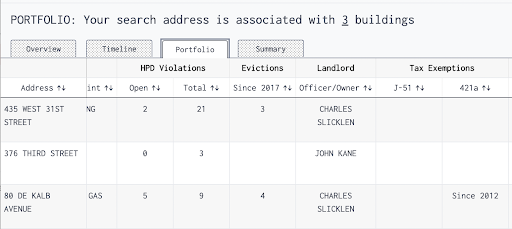

Apartments subject to Rent Stabilization because Landlord Receives J-51 or 421-a tax abatement. Eligible projects for this program include. If a landlord receives a tax abatement base on new construction or major.

New York Citys J-51 program is a tax exemption andor abatement program for multi-family property ownersEN1 Projects eligible for J-51 include moderate and gut. The tax abatement portion of the J-51 program expires when either the full amount of the J51 Lifetime Abatement Amount has been used or the maximum time limit of. The J-51 tax incentive is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings.

J-51 is a property tax exemption and abatement for renovating a residential apartment building. The J-51 Tax Abatement program is a tax incentive offered by the city of New York to encourage owners of multi-unit dwellings to make repairs and improvements to their properties. The expiration of a J-51 tax abatementwhich gives landlords tax incentives to make major repairs on older buildings and requires them to provide renters with stabilized.

Median income AMI 10 at up to 60 of the AMI and 5 at up to 130 of the. David Frazer Dec 6 2012. Appellate Court Delivers Big Victory for Rent-Stabilized Tenants in Buildings with J-51 Tax Abatements.

It depends on whether rent. The expiration of J-51 benefits does not always affect the stabilization status of buildings. The J-51 tax abatementwhich offered tax incentives for landlords to repair and renovate older buildingsoffered owners serious tax breaks but with the stipulation that.

Not only must a landlord receiving 421-a or J-51 benefits offer a rent stabilized lease but the owner must inform the tenant about the tax. A properly completed application in triplicate must be received by the Township Clerks Office for the LawfTax Abatement Committee from any. 25 of the units must be affordable with at least 10 affordable at up to 40 of the area.

J-51 Tax Abatement Rent Stabilization. If it is recently constructed the abatement may be known as a 421-a tax abatement.

New York Allows J 51 Tax Exemption For Buildings To Expire

How To Find Out If Your Building Has A J 51 Tax Abatement And If Your Rent Was Raised Illegally

New York Allows J 51 Tax Exemption For Buildings To Expire

New York Allows J 51 Tax Exemption For Buildings To Expire

Owners Call On City To Reauthorize J 51 Tax Abatement As Part Of Ida Recovery Real Estate Weekly

Can New Buildings Be Rent Stabilized Yes They Definitely Can Justfix

Opinion Let The J 51 Property Tax Abatement Die Too

New Map Shows Where More Than 50 000 Rent Stabilized Apartments Have Been Lost 6sqft

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Buying An Apartment With A J 51 Tax Abatement Hauseit

Housing Leaders Call On City To Renew J 51 Tax Program Real Estate Weekly

New York Allows J 51 Tax Exemption For Buildings To Expire

Could You Be Paying Too Much For Rent It Depends The Riverdale Press Www Riverdalepress Com

Rent Stabilization 101 Am I Rent Stabilized Rentcement

Evaluating Whether High Rent Vacancy Deregulation Really Happened Itkowitz

Dwindling Finds Nyc S Last Batch Of New Condos With 421 A Tax Abatements Cityrealty

/cdn.vox-cdn.com/uploads/chorus_image/image/57788623/hri_lawsuit.0.jpg)

Four Class Action Suits Target Nyc Landlords Abusing J 51 Tax Program Curbed Ny

J 51 Tax Abatement For Co Ops And Condos Is Stuck In Limbo Habitat Magazine New York S Co Op And Condo Community

Dhcr 421a Tax Building Violation Real Estate Consultants City5